When it comes to protecting one of your most significant investments—your vehicle—Premier Auto Protect stands out as a reliable and comprehensive solution.

As someone who has navigated the maze of auto warranties and service programs, I can confidently say that Premier Auto Protect offers the peace of mind every driver deserves.

Whether you’re looking to safeguard against unexpected repair bills or ensure seamless vehicle maintenance, Premier Auto Protect is worth considering.

My Experience With Premier Auto Protect

When I first started looking into auto protection plans, I was overwhelmed by the sheer number of options available. My car is a 2016 X5M with a branded title, which made finding comprehensive coverage a bit tricky.

That’s when I stumbled upon Premier Auto Protect, and honestly, it turned out to be one of the best decisions I’ve made for my vehicle.

From the moment I reached out, the experience was seamless. The representative I spoke with was not only knowledgeable but also incredibly patient, answering all my questions without making me feel rushed or pressured.

In just three minutes, I decided to purchase a warranty, which was a testament to the clarity and confidence the team instilled in me.

A few months into the plan, my car unexpectedly needed a new transmission. Panic set in initially, knowing how costly such a repair could be. However, Premier Auto Protect made the entire process effortless.

I called their support team, and they quickly connected me with a certified technician who handled everything directly with the repair center. The authorization was done over the phone, and within no time, my car was being fixed.

What impressed me most was the additional benefits that came with my plan. While my car was in the shop, Premier provided me with a free rental car, ensuring that my daily routine wasn’t disrupted.

This level of service was something I hadn’t expected but greatly appreciated. It wasn’t just about covering the repair costs; it was about making sure I was taken care of throughout the entire process.

Another aspect that stood out was their responsiveness. Even when I had specific needs due to a personal disability, the team was understanding and accommodating. Cameron, one of their representatives, communicated with me via text, making the interaction smooth and stress-free.

The package deal I received was better than what I had seen from competitors, with more flexible payment terms and generous mileage allowances.

Overall, my experience with Premier Auto Protect has been nothing short of excellent. Their comprehensive coverage, exceptional customer service, and thoughtful additional benefits have provided me with peace of mind knowing that my vehicle is well-protected.

If you’re on the fence about investing in an auto protection plan, I highly recommend giving Premier Auto Protect a try—you won’t be disappointed.

Pros of Premier Auto Protect

- Comprehensive Coverage: One of the standout features of Premier Auto Protect is its extensive coverage options. Unlike basic warranties that cover only essential components, Premier Auto Protect offers plans that include a wide range of services such as engine, transmission, electrical systems, and more. This comprehensive approach means fewer surprises and more support when your vehicle needs repairs.

- Exceptional Customer Service: From my experience and the reviews I’ve read, Premier Auto Protect excels in customer service. Representatives are knowledgeable, friendly, and quick to respond to your queries. Whether you’re purchasing a policy or filing a claim, the support team ensures that the process is smooth and hassle-free. This level of service builds trust and makes you feel valued as a customer.

- Flexibility and Customization: Premier Auto Protect offers a variety of plans that can be tailored to fit your budget and coverage needs. Whether you drive a brand-new car or an older model with a branded title, there’s a plan that suits you. This flexibility allows you to choose the level of protection that aligns with your financial situation and driving habits.

- Additional Benefits: Beyond basic coverage, Premier Auto Protect provides valuable extras such as free rental cars while your vehicle is being repaired, towing services, and roadside assistance. These benefits ensure that you’re not left without transportation during unexpected breakdowns, adding an extra layer of convenience and security.

Cons of Premier Auto Protect

- Cost Considerations: While Premier Auto Protect offers comprehensive coverage, the cost can be a significant factor for some drivers. Depending on the level of coverage you choose, premiums can vary. It’s essential to evaluate your budget and determine if the benefits outweigh the costs for your specific situation.

- Limited Availability: Premier Auto Protect is available nationwide, but there might be limitations based on your location. Some regions may have more restricted access to certain services or coverage options. It’s crucial to check the availability in your area before committing to a plan.

- Claim Processing Time: Although Premier Auto Protect is known for its efficient service, there can be instances where claim processing takes longer than expected. Delays in authorization or repairs can be frustrating, especially when you’re relying on your vehicle for daily activities. Ensuring clear communication with the support team can help mitigate these issues.

Maintenance Tips With Premier Auto Protect

- Regular Vehicle Check-Ups: Preventative maintenance is key to avoiding unexpected repairs. Premier Auto Protect emphasizes the importance of regular check-ups and servicing to keep your vehicle running smoothly. By adhering to your car’s maintenance schedule, you can reduce the likelihood of major breakdowns and extend the life of your vehicle.

- Understanding Your Coverage: It’s essential to fully understand what your Premier Auto Protect plan covers. Familiarize yourself with the terms and conditions, including what components are included and any exclusions that may apply. This knowledge ensures that you’re prepared when you need to file a claim and can maximize the benefits of your coverage.

- Keeping Documentation Handy: Always keep your policy documents and contact information readily accessible. In the event of a breakdown or needed repair, having all necessary information at your fingertips can expedite the claims process and reduce stress during an already challenging situation.

- Utilizing Roadside Assistance: Take advantage of the roadside assistance services offered by Premier Auto Protect. Whether you need a tow, a jump start, or tire changes, these services provide immediate help, ensuring that you’re not left stranded when your vehicle encounters issues.

Comparing Premier Auto Protect With Other Brands

When evaluating auto protection plans, it’s crucial to compare Premier Auto Protect with other leading brands to determine the best fit for your needs. Here’s how Premier stacks up against some of the top competitors:

- Premier Auto Protect Vs. Empire Auto Protect

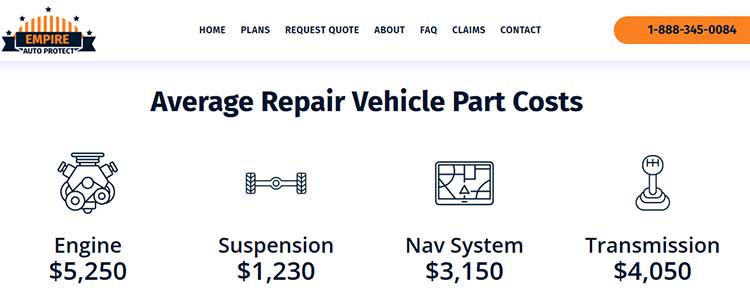

When I compared Premier Auto Protect with Empire Auto Protect, the differences became clear. Premier offers more flexible payment options, which was a big plus for me. Empire Auto Protect, while competitive in pricing, didn’t provide the same level of customization.

Additionally, Premier’s customer service stood out with their responsive and knowledgeable representatives, making the entire purchasing process smooth and reassuring.

On the other hand, Empire Auto Protect has a solid reputation but lacks some of the comprehensive benefits that Premier includes, such as free rental cars during repairs.

- Premier Auto Protect Vs. CarShield

CarShield is widely recognized for its variety of plans and extensive coverage options, making it a strong competitor in the auto protection industry. However, Premier Auto Protect often takes the lead with its user-friendly approach and superior customer satisfaction.

While CarShield may offer lower initial premiums, Premier’s plans typically include more inclusive benefits and better long-term value. Customers frequently highlight Premier’s efficient claim handling and the ease of working directly with certified technicians, which can lead to faster repairs and less downtime.

Additionally, Premier’s flexibility in customizing plans to fit individual needs ensures that drivers receive tailored protection, something that CarShield may not always provide to the same extent.

- Premier Auto Protect Vs. Protect My Car

Protect My Car is another prominent player in the auto protection market, known for its easy-to-understand plans and affordable rates. However, Premier Auto Protect differentiates itself with more extensive coverage options and additional perks.

While Protect My Car offers essential protection for major components, Premier goes a step further by including benefits such as towing services and rental car reimbursement, which can be crucial during unexpected breakdowns.

Furthermore, Premier’s customer service receives high praise for being responsive and personalized, whereas Protect My Car, although reliable, may not offer the same level of individualized attention.

For drivers seeking a more comprehensive and supportive auto protection plan, Premier Auto Protect is often the superior choice.

Frequently Asked Questions (FAQ)

Absolutely. Premier Auto Protect offers comprehensive coverage that can save you from unexpected and costly repairs. The added benefits like roadside assistance and rental car coverage provide extra value, making it a worthwhile investment for peace of mind.

While “best” can be subjective and depends on individual needs, Premier Auto Protect consistently ranks high due to its extensive coverage options, excellent customer service, and flexible plans. Other top contenders include CarShield, Endurance, Protect My Car, and Toco Warranty, each offering unique strengths.

Premier Auto Protect covers a wide range of vehicle components, including engine, transmission, electrical systems, and more. Additionally, their plans often include benefits like towing, roadside assistance, and rental car coverage. It’s essential to review the specific terms of your plan to understand all included services.

Premier Auto Protect is among the top auto warranty companies, known for its comprehensive coverage and exceptional customer service. However, the best company for you will depend on your specific needs, budget, and vehicle type. It’s advisable to compare several providers to find the perfect match.

Final Thoughts

Choosing the right auto protection plan is crucial for maintaining your vehicle and protecting your finances. Premier Auto Protect offers a robust solution with its comprehensive coverage, exceptional customer service, and valuable additional benefits.

Whether you’re a new driver or someone with an older vehicle, Premier Auto Protect provides the security and support you need to drive with confidence. Investing in their Vehicle Service Program is not just a smart financial decision—it’s a commitment to peace of mind on every journey.